mississippi income tax rate

2023 Mississippi Tax Tables with 2023 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. This calculator estimates the average tax rate as the state income tax liability divided by the total gross income.

/images/2022/01/18/individual-tax-rates-by-state.png)

Here Are The States Where Tax Filers Are Paying The Highest Percentage Of Their Income Financebuzz

At what rate does Mississippi tax my income.

. What Are The Mississippi Tax Brackets. These rates are the same for individuals and businesses. The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022.

Mississippi Tax Brackets for Tax Year 2021. These rates are the same for individuals and businesses. Mississippi has a graduated individual income tax with rates ranging from 400 percent to 500 percent.

As you can see your income in Mississippi is taxed at different rates within the given tax brackets. The graduated income tax rate is. Outlook for the 2023.

Mississippi income tax rate and tax brackets shown in the table below are based on income earned between January 1 2022 through December 31 2022. 3 on the next 2000 of. Mississippi has a graduated tax rate.

Mississippi also has a 400 to 500 percent corporate income tax rate. Combined Filers - Filing and Payment Procedures. Tate Reeves promised to push for a full elimination of the states income tax during the 2023 legislative session.

AP Mississippi residents will pay lower income taxes in coming years as the state enacts its largest-ever tax cut. The personal income tax which has a top rate of 5 is slightly lower than the national average for state income taxes. There is no tax schedule for Mississippi income taxes.

Mississippi individual income tax rates vary from 0 to 5 depending upon filing status and taxable income. All other income tax returns P. Eligible Charitable Organizations Information.

However the statewide sales tax of 7 is slightly. JACKSON Miss AP Mississippi Gov. Tate Reeves on Tuesday signed a bill that.

Mississippi collects a state corporate income tax at a maximum marginal tax rate of 5000 spread across three tax brackets. Box 23058 Jackson MS 39225-3058. Tate Reeves promised to push for a full elimination of the states income tax during the 2023 legislative session.

Compare your take home after tax and estimate. Mississippis maximum marginal corporate income tax rate. Box 23050 Jackson MS 39225-3050.

1 day agoEarly this year at the culmination of the Legislatures 2022 session Reeves signed House Bill 531 into law which transitions the state away from its two-rate individual income. Mississippi has a graduated tax rate. Mailing Address Information.

If you are receiving a refund PO. How do I compute the income tax due. Compare your take home after tax and estimate.

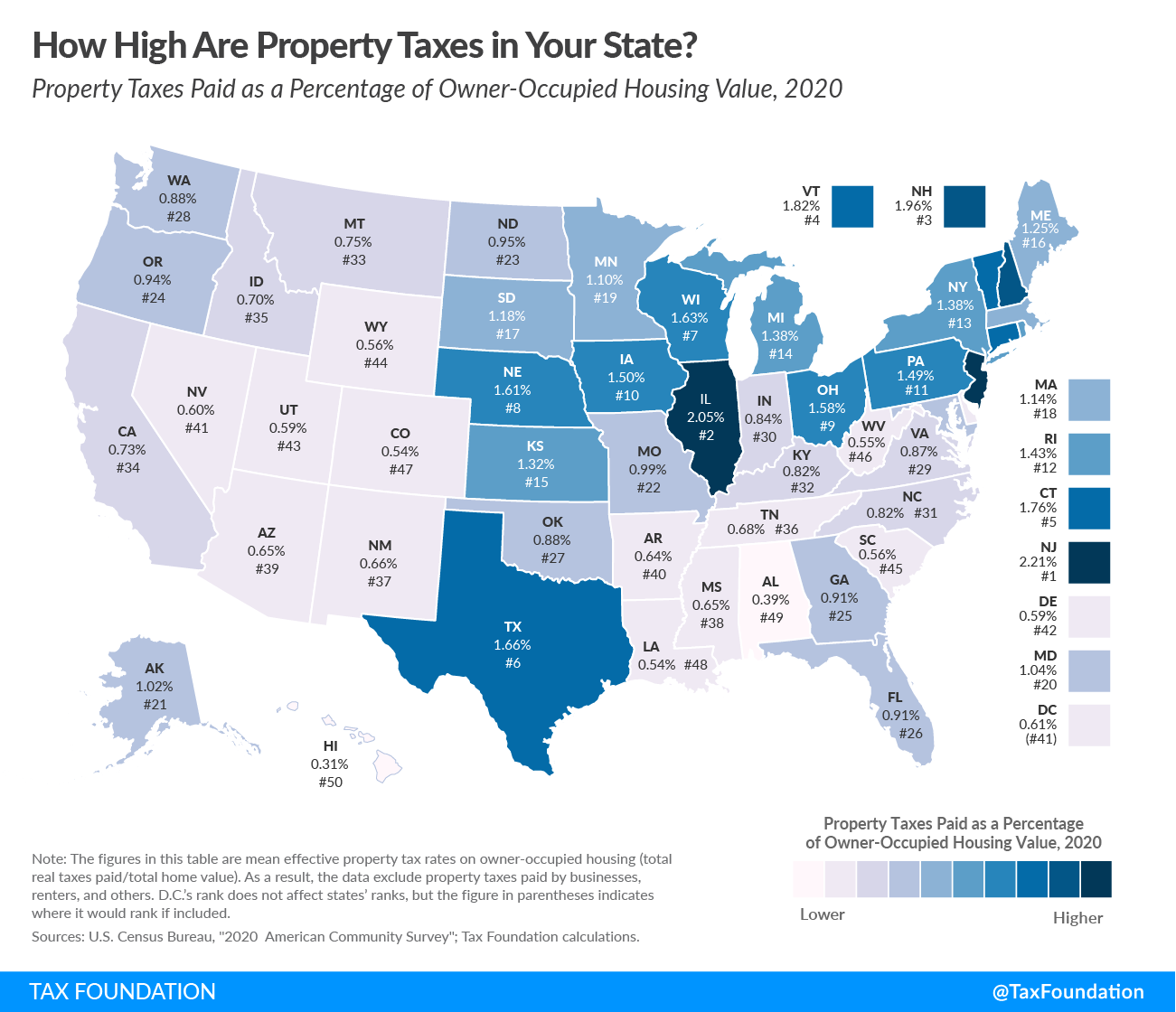

Mississippis income tax brackets were last changed four years prior to 2020 for tax year 2016 and the tax rates have not been changed since at least 2001. Hurricane Katrina Information. All sales of tangible personal property in the State of Mississippi are subject to the regular retail rate of sales tax 7 unless the law exempts the item or provides a reduced rate.

0 on the first 3000 of taxable income. Mississippi Income Tax Calculator 2021. Mississippis sales tax rate consists of a state tax 7 percent and local tax 007 percent.

Any income over 10000 would be taxes at the. Mississippi has a graduated income tax rate and is computed as follows. Here is information about Mississippi Tax brackets from the states Department of Revenue.

2022 Mississippi Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. JACKSON Miss AP Mississippi Gov. If you move after filing your Mississippi income tax return you will need to notify the Department of Revenue of your new address by letter to.

Detailed Mississippi state income tax rates and brackets are available on.

Mississippi State Taxes 2021 Income And Sales Tax Rates Bankrate

Will Mississippi Join The No Income Tax Club

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Mississippi State Tax Payment Plan Details

How Do State And Local Sales Taxes Work Tax Policy Center

Mississippi Governor Signs State S Largest Income Tax Cut

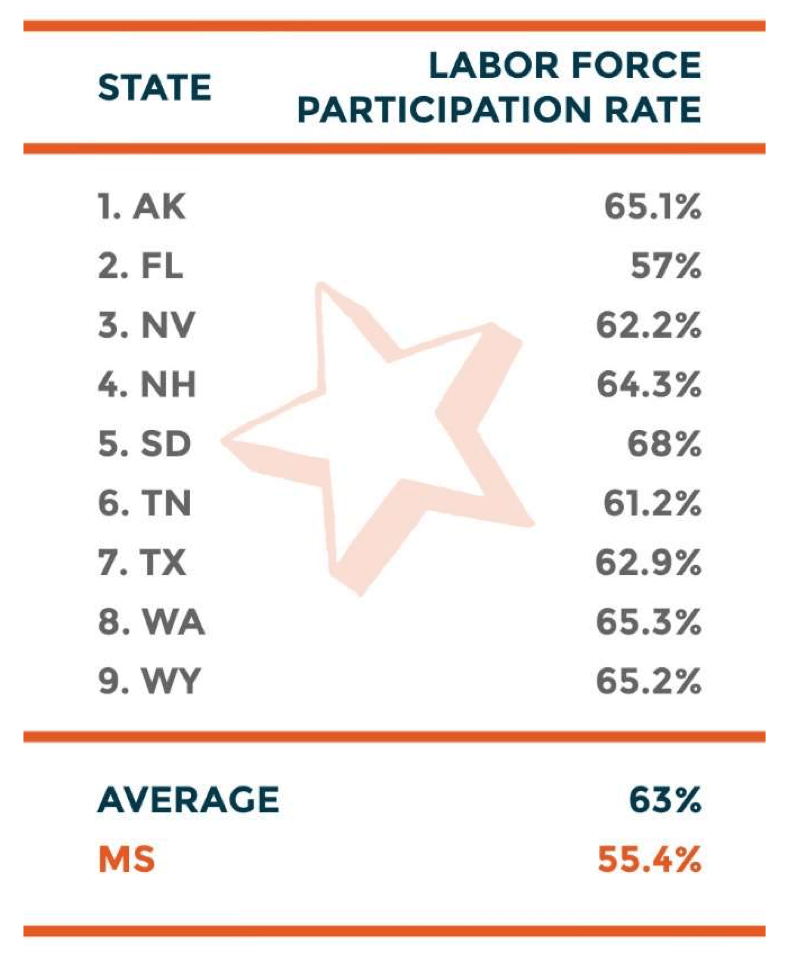

The Economies Of Income Tax Free States

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

The Most And Least Tax Friendly Us States

Mississippi Tax Rate H R Block

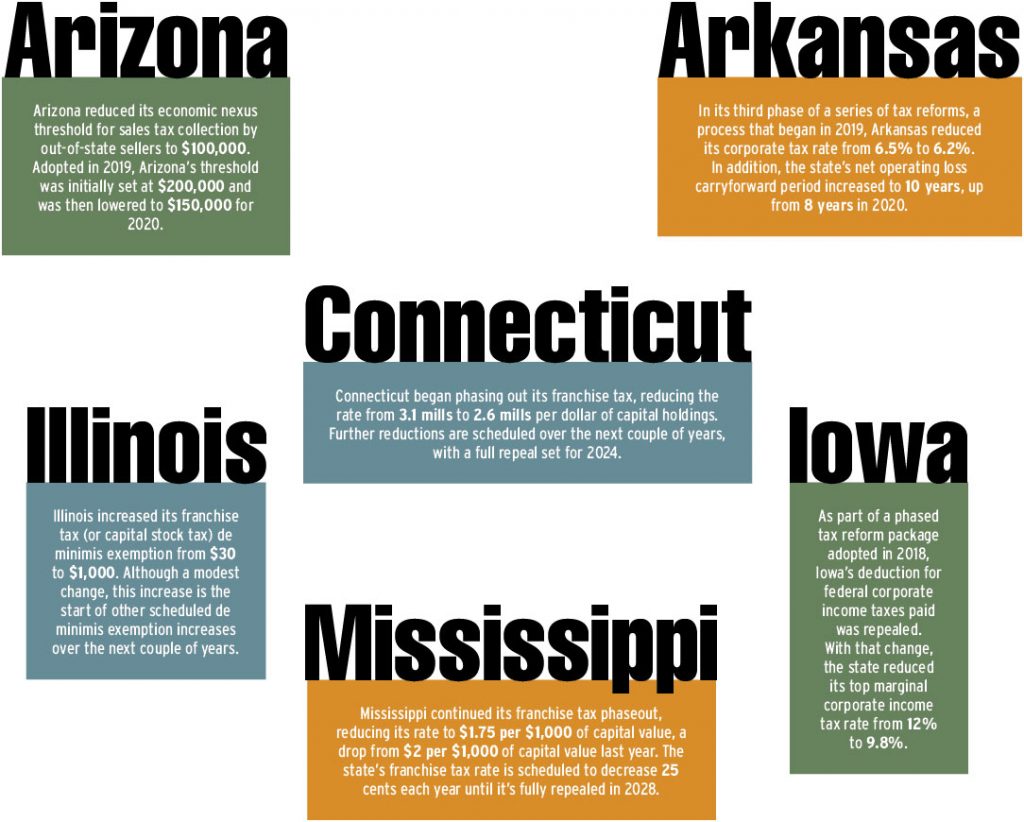

State Tax Updates In 2021 Tax Executive

How To Form An Llc In Mississippi Llc Filing Ms Swyft Filings

Mississippi Tax Rate H R Block

State Income Taxes Highest Lowest Where They Aren T Collected

Mississippi Tax Cut Taking Effect July 1

Filing Mississippi State Tax Returns Things To Know Credit Karma

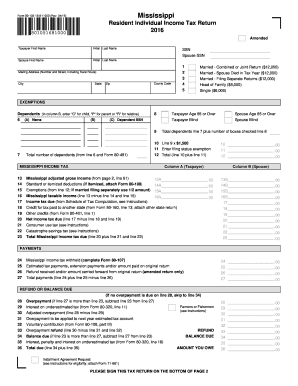

Mississippi Resident Individual Income Tax Return Fill Out And Sign Printable Pdf Template Signnow

Delbert Hosemann On Twitter The Senate Took Final Action On A Historic 524 1m Income Tax Cut Today Moving To A Flat 4 Rate Makes Mississippi One Of The Most Competitive In The